Fashion retailers are missing out on one trend.

December 8, 2016

The world’s stock exchanges are possibly at the cutting edge of applying data quickly to derive insight that allows decisions to be made. A new trading infrastructure for the NASDAQ will use IBM WebSphere MQ Low Latency Messaging and Linux to make it the fastest stock exchange software on the planet. It can easily execute more than a million trades per second and is milliseconds per trade faster than its nearest competitor – and that’s a game changer.

The fact is that there are many industries that use data and fast/instant analytics to react quickly or real-time to changing conditions in their marketplaces. However, fashion retail hasn’t yet caught up and a lot of the work done in keeping that competitive edge in fashion retail is still manually processed.

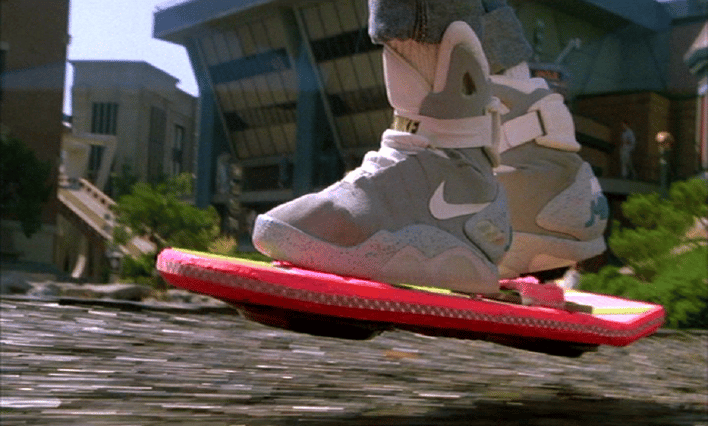

OK, so the promise that the 1989 movie Back to the Future II gave us of clothes that would shape-shift to fit our individual bodies hasn’t eventuated. While that scene of Marty McFly Jnr on the pavement was set in the year 2015 and even with technology that pervades every aspect of life today, this tech simply isn’t a reality. While fashion continues to shape and be a major marker of modern culture, the technology the industry uses, particularly in its operations, has been behind the ball.

In the last few years we, the consumer, have moved past being impressed (or worried for that matter) by technological advances. A little like in the late 19th Century when electricity moved from powering gadgets to being omnipresent. The result being that no one today says “I’m going to make a cup with my electric coffee machine”, it’s just a coffee machine. The idea that the delineation of smart things and non-smart things is now becoming blurred to the point irrelevance – everything is smart.

Moores’ Law said that computing power would double every year, and this has largely been the case. But that’s nothing compared to the data all the computing power generates. The volume of data we generate doubles every 4 months. To put this in perspective 2.5 Quintillion bytes of data are now created every 24 hours. One reality of all this connection, computing power and massive amounts of data being generated is that, unless you’re a stock exchange, the systems and processes are yet too sufficiently evolved to give meaningful insight. And this is particularly true in the world of fashion retail.

What’s happening in Fashion Retail?

Insight is what the fashion retailer, specifically their buyer or operations manager, needs to make decisions on what they sell. More than that, they need that insight fast. Yes, the internet has changed how we are influenced in what we wear and eCommerce has given us new ways to consume those things we want. But no matter the amount of technology available today, the buying habits of the fashion consumer have remained focused on the weekend. Seventy per cent of all on and offline fashion purchases globally occur on Saturdays and Sundays.

As a result of this consistent behaviour, the fashion retailer’s life continues to revolve around this – and with incredible pressure. A typical week for a buyer might look like this… Monday starts with a review of the weekend’s sales, followed by pressure on how to improve the mix for the following weekend. A clear understanding of how the competitors performed is also critical. That same day plans are being put in place ready to action immediately. And before they know it, they are back in the Monday meeting with a disapproving MD. Yes, there are some long-term planning activities (those that make their friends insanely jealous – like a buying trip to Milan), but otherwise the weeks just repeat themselves over and over again.

Consumers too have a growing expectation that product mixes will change quickly and what we saw on Keeping Up With The Kardashians last night will be available for us to buy this weekend. This has led to massive changes in the supply chain. One retailer that capitalises on the fast-paced retail environment is China’s website Taobao. You can see Hervé Léger’s new ready-to-wear collection on TV today, and the next week their dresses will be copied and selling on Taobao for a fraction of what they normally cost. While by Western standards they have a notorious reputation for their copycat schemes, to the Asian market, this is convenience at its best. Shoppers can have Western luxury looks delivered to their doorstep without having to wait or save for it.

Fashion ripe for a little disruption?

So, the supply chain side of the fashion industry has certainly innovated and as a result, great things are happening, but what of the competitive analysis side of things, the “comp shop” or the “range review” for example? How are retailers using technology to keep tabs on this ever expanding and fast moving competitive landscape?

The fashion industry, like many other verticals, have been sold the big-data promise for a while. The reality for a high-pressured, fast turnover industry like this though, is that there is just too much data to make sense of. The pie is too big to eat and digest. As a result, it is simply easier to stick to old habits. After all, the consumers buying behaviour has remained the same too.

What fashion retailers need is small data. We need to take a scalpel to all the data that is available to us and extract just what we need as quickly as possible, rather than using a sledgehammer to make a mess. To quote Einstein – I don’t need information I just need the insights we can glean from it.

Competition continues to be the driving force in affecting business models across the world. Analytics and software that provide provides insight to competitor activity, quickly and efficiently are beginning to drive significant impact on the businesses they cover. And stock exchanges are a great proof point of this. Retail analytics is one more area ripe for disruption. The next challenge is in presenting this type of analytics to creative fashion people – people who may feel physically sick looking at spreadsheets.The world’s stock exchanges are possibly at the cutting edge of applying data quickly to derive insight that allows decisions to be made. A new trading infrastructure for the NASDAQ will use IBM WebSphere MQ Low Latency Messaging and Linux to make it the fastest stock exchange software on the planet. It can easily execute more than a million trades per second and is milliseconds per trade faster than its nearest competitor – and that’s a game changer.

The fact is that there are many industries that use data and fast/instant analytics to react quickly or real-time to changing conditions in their marketplaces. However, fashion retail hasn’t yet caught up and a lot of the work done in keeping that competitive edge in fashion retail is still manually processed.

OK, so the promise that the 1989 movie Back to the Future II gave us of clothes that would shape-shift to fit our individual bodies hasn’t eventuated. While that scene of Marty McFly Jnr on the pavement was set in the year 2015 and even with technology that pervades every aspect of life today, this tech simply isn’t a reality. While fashion continues to shape and be a major marker of modern culture, the technology the industry uses, particularly in its operations, has been behind the ball.

In the last few years we, the consumer, have moved past being impressed (or worried for that matter) by technological advances. A little like in the late 19th Century when electricity moved from powering gadgets to being omnipresent. The result being that no one today says “I’m going to make a cup with my electric coffee machine”, it’s just a coffee machine. The idea that the delineation of smart things and non-smart things is now becoming blurred to the point irrelevance – everything is smart.

Moores’ Law said that computing power would double every year, and this has largely been the case. But that’s nothing compared to the data all the computing power generates. The volume of data we generate doubles every 4 months. To put this in perspective 2.5 Quintillion bytes of data are now created every 24 hours. One reality of all this connection, computing power and massive amounts of data being generated is that, unless you’re a stock exchange, the systems and processes are yet too sufficiently evolved to give meaningful insight. And this is particularly true in the world of fashion retail.

What’s happening in Fashion Retail?

Insight is what the fashion retailer, specifically their buyer or operations manager, needs to make decisions on what they sell. More than that, they need that insight fast. Yes, the internet has changed how we are influenced in what we wear and eCommerce has given us new ways to consume those things we want. But no matter the amount of technology available today, the buying habits of the fashion consumer have remained focused on the weekend. Seventy per cent of all on and offline fashion purchases globally occur on Saturdays and Sundays.

As a result of this consistent behaviour, the fashion retailer’s life continues to revolve around this – and with incredible pressure. A typical week for a buyer might look like this… Monday starts with a review of the weekend’s sales, followed by pressure on how to improve the mix for the following weekend. A clear understanding of how the competitors performed is also critical. That same day plans are being put in place ready to action immediately. And before they know it, they are back in the Monday meeting with a disapproving MD. Yes, there are some long-term planning activities (those that make their friends insanely jealous – like a buying trip to Milan), but otherwise the weeks just repeat themselves over and over again.

Consumers too have a growing expectation that product mixes will change quickly and what we saw on Keeping Up With The Kardashians last night will be available for us to buy this weekend. This has led to massive changes in the supply chain. One retailer that capitalises on the fast-paced retail environment is China’s website Taobao. You can see Hervé Léger’s new ready-to-wear collection on TV today, and the next week their dresses will be copied and selling on Taobao for a fraction of what they normally cost. While by Western standards they have a notorious reputation for their copycat schemes, to the Asian market, this is convenience at its best. Shoppers can have Western luxury looks delivered to their doorstep without having to wait or save for it.

Fashion ripe for a little disruption?

So, the supply chain side of the fashion industry has certainly innovated and as a result, great things are happening, but what of the competitive analysis side of things, the “comp shop” or the “range review” for example? How are retailers using technology to keep tabs on this ever expanding and fast moving competitive landscape?

The fashion industry, like many other verticals, have been sold the big-data promise for a while. The reality for a high-pressured, fast turnover industry like this though, is that there is just too much data to make sense of. The pie is too big to eat and digest. As a result, it is simply easier to stick to old habits. After all, the consumers buying behaviour has remained the same too.

What fashion retailers need is small data. We need to take a scalpel to all the data that is available to us and extract just what we need as quickly as possible, rather than using a sledgehammer to make a mess. To quote Einstein – I don’t need information I just need the insights we can glean from it.

Competition continues to be the driving force in affecting business models across the world. Analytics and software that provide provides insight to competitor activity, quickly and efficiently are beginning to drive significant impact on the businesses they cover. And stock exchanges are a great proof point of this. Retail analytics is one more area ripe for disruption. The next challenge is in presenting this type of analytics to creative fashion people – people who may feel physically sick looking at spreadsheets.